Governor Landry Addresses Insurance Reforms/Crime

by: D. D. Reese

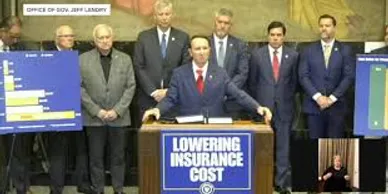

Governor Jeff Landry is intensifying efforts to tackle Louisiana's mounting insurance crisis while navigating persistent concerns over crime rates. In recent weeks, Landry has signed a series of insurance reform bills and advocated for measures aimed at reducing premiums, positioning these initiatives as central to his administration's agenda.

Sweeping Insurance Reforms Enacted

On May 28, Governor Landry signed what he described as the largest tort reform package in Louisiana's history. The legislation includes provisions to expand the state insurance commissioner's authority over rate hikes, limit attorney fees, and offer tax credits for safety measures like dashboard cameras in commercial vehicles. Landry emphasized that these reforms aim to curb frivolous lawsuits and hold insurance companies accountable to policyholders.

Additionally, Landry has supported bipartisan efforts to increase transparency in how insurers calculate premiums. Proposals include requiring disclosure of rate-setting algorithms and prohibiting insurance companies from passing advertising expenses onto consumers. These measures seek to address the state's high insurance costs, which average $3,998 annually for full coverage, with rates exceeding $5,400 in New Orleans.

Crime Rates Remain a Pressing Issue

While insurance reforms have taken center stage, crime remains a significant concern for Louisiana residents. Governor Landry has previously enacted measures to address criminal justice issues, including reversing certain reforms and increasing penalties for specific offenses. However, critics argue that more comprehensive strategies are needed to effectively reduce crime rates and enhance public safety.

Pros and Cons of the Reforms

Pros:

Potential Reduction in Insurance Costs: The reforms aim to lower premiums by addressing factors contributing to high insurance rates, such as litigation costs and lack of transparency.

Enhanced Regulatory Oversight: Expanding the insurance commissioner's authority could lead to more effective regulation of the insurance industry.

Cons:

Uncertain Impact on Premiums: Some experts and lawmakers express skepticism about whether the reforms will lead to significant reductions in insurance costs for consumers.

Potential Legal Challenges: The sweeping nature of the tort reform package may face legal scrutiny, potentially delaying implementation.

Looking Ahead

Governor Landry's administration continues to prioritize insurance reform as a means to alleviate financial burdens on Louisiana residents. As these measures take effect, their impact on insurance costs and the broader economy will be closely monitored. Simultaneously, addressing the state's crime rates remains a critical challenge requiring ongoing attention and action.